MT940 statement format

Format overview

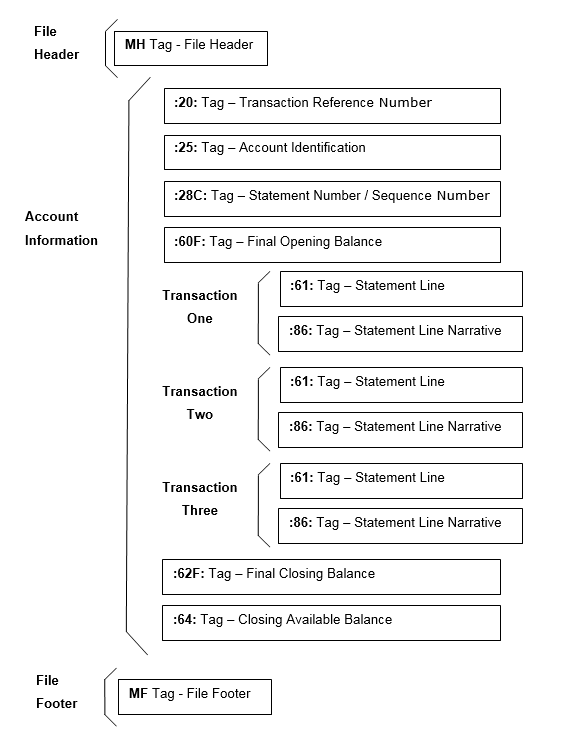

An example of the Domestic BankRec MT940 file format layout structure is indicated in the diagram below. If you require statements for multiple accounts you can opt to receive a separate statement per account or a single statement combining data for all accounts.

Default file name format

The default file name will be generated as BankStatement_CONFIGCODE_DATE.txt where CONFIGCODE is the configuration code and DATE is the statement date.

File specification

| Tag | Field Name | Field Description / Characteristics | Data Format (length) | Mandatory / Optional |

|---|---|---|---|---|

| N/A | Message Header | The Message Header opens the Domestic MT940 message. It includes the sender and destination BIC. It will be populated with a value of:{1:F01WPACAU2SAXXX0000000000}{2:I940WIBSXXXXN}{4:In this example the sender BIC is WPACAU2SAXXX and the destination BIC is WIBSXXXXN. These values will be hardcoded in the statements you received. |

Alphanumeric (variable) | Mandatory |

| :20: | Transaction Reference Number | This field contains a BankRec generated transaction reference which unambiguously identifies the message. It will be populated with the characters "CSCT" followed by the "Account BSB" and "Account Number". For Example :20:CSCT032002123465 |

Alphanumeric (16) | Mandatory |

| :25: | Account Identification | This field identifies current account the account. It will be populated with the "Account BSB" and "Account Number". For Example :25:032002123465 |

Alphanumeric (12) | Mandatory |

| :28C: | Statement Number / Sequence Number | This field contains the Statement Number, followed by the Sequence Number, separated by a / character.The Statement Number represents the banking day on which the subsequent transactions occurred. This will be an incrementing sequence. For example, the Statement Number for the first banking day of the year would be 00001 etc.The Sequence Number will be populated with 001. This value will only change for messages sent via the SWIFT network (see SWIFT Support).For Example: :28C:00001/001. |

Numeric (5/3) | Mandatory |

| :60F: | Opening Balance (final) | This field contains the "final opening balance". It will be populated as follows:

:60F:C171120AUD98838,27Details reported in this tag will match those reported in the previous statements Final Closing Balance. |

Alphanumeric (29) | Mandatory |

| :61: | Statement Line | This tag represents a Bank Statement Line for the current Bank Statement. It will be populated as follows:

For Example (including supplementary reference): :61:1507020702D115945,00F014NARRATIVE//0207150143062089CRLF1234567890 |

Alphanumeric (65 for line 1) (34 for line 2) | Optional |

| :86: | Statement Line Narrative | This field reports additional information about the transaction described in the preceding statement line (:61:) |

Alphanumeric (6 lines of 240 characters) | Optional |

| :62F: | Closing Balance (Final) | This field contains the "final" closing balance. It will be populated as follows:

:62F:C091120AUD98838,27 |

Alphanumeric (29) | Mandatory |

| :64: | Closing Available Balance | This field reports any funds that are available to the account owner if the account is in "credit" or the balance on the account that will be subject to interest charges if the account is in "debit". It will be populated as follows:

:64:C091120AUD98838,27 |

Alphanumeric (29) | Optional |

| N/A | Message Footer | The Footer Record closes the Domestic MT940 message. It will be populated with a fixed value of -}. |

Alphanumeric (2) | Mandatory |

MT940 transaction codes

The Transaction Code that appears within each :61: entry can be used to determine the type of transaction. For example, a Westpac 070 Transaction Code represents a direct credit into your account.

There are three options available when determining the transaction codes that will be used for :61: entries, how you select an option will be dependent on whether any enrichment is performed, and whether your message is transmitted via the SWIFT Network:

- Default Westpac MT940 Transaction Codes

- SWIFT Transaction MT940 Codes

- Custom Transaction MT940 Codes

Default Westpac MT940 transaction codes

This is the simplest option for most customers. Westpac Transaction Codes will be used and prefixed with an F.

For Example: F050.

SWIFT MT940 transaction codes

If the BankRec MT940 message is to be delivered over SWIFT FIN, or if the customer prefers, transmission specific restrictions necessitate the use of official SWIFT transaction codes.

For Example: NMSC

Custom MT940 transaction codes

If none of the Transaction Code schemes suit your specific needs you can discuss customising them to better fit your requirements.

Note: this is non-standard and there will be additional fees to collect the requirements and maintain the custom mapping.

Enrichment support

If you receive a data-enriched (bulked, reconciled, debulked or enriched) statement there will be some modifications to the transaction (:61:) records.

Bulked/reconciled enrichment

For bulked and reconciled enrichment, the following modifications will be performed to the :61: tag lines:

Transaction Number: This field will be populated with theBatch Payment Reference Code.Bank Reference: This field will be populated with a unique, BankRec-generated transaction identifier.Supplementary Reference: This field will be populated with theBatch Payment Code.

Debulked receivables enrichment

For debulked receivables enrichment, the following modifications will be performed to the :61: tag lines:

- Each

:61:line that previously represented a bulk settlement record will be replaced with multiple:61:that represent the individual payments that formed part of the bulk settlement. Transaction Number: This field will be populated with theCustomer Reference Number.Bank Reference: This field will be populated with a unique, BankRec-generated transaction identifier.Supplementary Reference: If available, this field will be populated with thePayment Reference.

Note: For debulked lines there will be no :86: tags.

Debulked payables enrichment

For debulked payables enrichment, the following modifications will be performed to the :61: tag lines:

- Each

:61:line that previously represented a bulk settlement record will be replaced with multiple:61:that represent individual payments that formed part of the bulk settlement. Transaction Number: This field will be populated with thePayer Reference(a unique payment reference you provide).Bank Reference: This field will be populated with a unique, BankRec-generated transaction identifier.Supplementary Reference: If available, this field will be populated with thePayee Reference(a payment reference you provide that can appear on your customers statements).

Note: For debulked lines there will be no :86: tags.

External entry enrichment

For external entry enrichment (i.e, transactions enriched with information from an external EFT feed), the following modifications will be performed the the :61: tag lines:

Transaction Number: This field will be populated with theReferencesourced from the external feed.Bank Reference: This field will be populated with theCustomer Codeif available, otherwise blank.Supplementary Reference: This field will be populated with theRemitter Namesourced from the external entry.

If you require different reference fields to be included in your statement you should discuss it during your implementation

SWIFT support

When producing MT940's that are compatible with SWIFT network transmissions a number of caveats/alternations need to be performed, most notably, Transaction Code manipulation. If you require messages to be delivered over the SWIFT Network please discuss this with your implementation resources during your project.

Sample files

The following files are intended to be examples only.

NPP sample transactions

Download the NPP sample MT940 file.

This file contains examples of all NPP transaction codes, and how they will appear in a standard MT940 statement.