ISO 20022 cash management

Cash management processes use ISO 20022 camt.053.001.02 messages according to the CGI (Common Global Implementation).

BankRec produces a camt.053.001.002 bank statement with Australian transactions.

File validation

camt.053.001.02 files are compliant with the v2 XML schema on ISO 200200 Bank to Customer messages (CGI compliant version).

camt.053.001.02

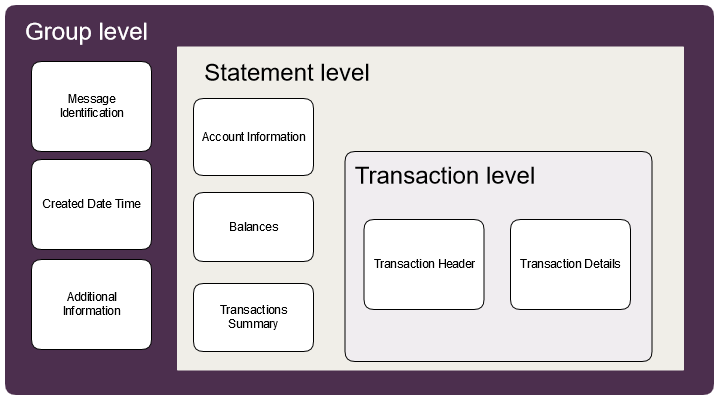

The structure of a camt.053.001.02 file is:

- Many accounts can be present in one file.

- There will be one header for each statement containing date/time, balances and BSB/Account details.

- A statement can have any number of transaction records, each containing the details of a transaction.

- Most transactions are single amounts or a bulked amount of other composite transactions (e.g. a total BPAY settlement). These are called bulked transactions.

- Some transactions can be broken down into individual sub-transactions (e.g. individual BPAY payments). These are called debulked transactions and will also contain the bulked settlement amount.

- One block at the 'Group Level'.

- One 'Message Identification'

- One 'Created Date Time'

- One 'Additional Information'

- One or more blocks at the 'Statement Level' (for each account)

- One 'Account Information'

- Three 'Balances' (opening, closing and available)

- One 'Transaction Summary'

- Zero or more blocks at the 'Transaction Level'

- One 'Transaction Header'

- One or more 'Transaction Details'

Important: Please refer to the v2 XML schema on ISO 200200 Bank to Customer messages (CGI compliant version).

Group level

<BkToCstmrStmt>

<GrpHdr>

<MsgId>6438754992</MsgId>

<CreDtTm>2017-12-06T01:19:25</CreDtTm>

<AddtlInf>EODY</AddtlInf>

</GrpHdr>

...

</BkToCstmrStmt>- The

MsgIdis a unique number created for every camt.053.001.02 statement file. Use this combined with the statement level sequence number (if you have multiple accounts per file) to ensure you do not process the same file twice. CreDtTmis the time stamp showing when the file was generated.AddtlInfidentifies the type of statement file.EODYindicates that it is an end-of-day statement.

| Lev | ISO XML element | Message Item | Req | Format | Example, Description or element name |

|---|---|---|---|---|---|

| 1 | <Document> |

M | |||

| 2 | <BkToCstmrStmt> |

Bank to Customer Statement | M | <BkToCstmrStmt> |

|

| 3 | <GrpHdr> |

Group Header | M | <GrpHdr> |

|

| 4 | <MsgId> |

Message Identification | M | 1000044716 |

|

| 4 | <CreDtTm> |

Creation Date Time | M | yyyy-MM-dd'T'HH:mm:ss |

2018-12-14T14:05:41 |

| 4 | <AddtlInf> |

Additional Information | M | EODY |

Statement level

<Stmt>

<Id>0320011234562017-12-06T01:19:25</Id>

<ElctrncSeqNb>142</ElctrncSeqNb>

<CreDtTm>2017-12-06T01:19:25</CreDtTm>

<FrToDt>

<FrDtTm>2017-12-05T00:00:00</FrDtTm>

<ToDtTm>2017-12-05T23:59:59</ToDtTm>

</FrToDt>

<Acct></Acct>

<Bal></Bal>

...

</Stmt>- The

Idcomprises of the BSB and account number and the time stamp. CreDtTmis the time stamp showing when the statement was generated.- The from and to time stamps indicate the period that the transactions in the statement represent.

| Lev | ISO XML element | Message Item | Req | Format | Example, Description or element name |

|---|---|---|---|---|---|

| 2 | <Stmt> |

Statement | M | <Stmt> |

|

| 3 | <Id> |

Payment Information Identification | M | BSB + Account + Timestamp | 0320011234562017-12-06T01:19:25 |

| 3 | <ElctrncSeqNb> |

Electronic Sequence Number | M | Numeric | 142 |

| 3 | <CreDtTm> |

Creation Date Time | M | yyyy-MM-dd'T'HH:mm:ss |

2017-12-06T01:19:25 |

| 3 | <FrToDt> |

From To Date | M | <FrToDt> |

|

| 4 | <FrDtTm> |

From Date Time | M | yyyy-MM-dd'T'HH:mm:ss |

2017-12-05T00:00:00 |

| 4 | <ToDtTm> |

To Date Time | M | yyyy-MM-dd'T'HH:mm:ss |

2017-12-05T23:59:59 |

Account information

<Acct>

<Id>

<Othr>

<Id>032001123456</Id>

</Othr>

</Id>

<Ccy>AUD</Ccy>

<Svcr>

<FinInstnId>

<BIC>WPACAU2S</BIC>

</FinInstnId>

</Svcr>

</Acct>- The

Idis the BSB and account number. - The

Ccyfield identifies the currency of the amounts presented in the file. - The

BICfield is the Swift code of the institution that produced the file.

| Lev | ISO XML element | Message Item | Req | Format | Example, Description or element name |

|---|---|---|---|---|---|

| 3 | <Acct> |

Account | M | <Acct> |

|

| 4 | <Id> |

Id | M | <Id> |

|

| 5 | <Othr> |

Other | M | <Othr> |

|

| 6 | <Id> |

Id | M | BSB + Account | 032999999994 for 032-999 999994 |

| 4 | <Ccy> |

Currency | M | ISO 4217 currency code | AUD |

| 4 | <Svcr> |

Servicer | M | <Svcr> |

|

| 5 | <FinInstnId> |

Financial Institution Identification | M | <FinInstnId> |

|

| 6 | <BIC> |

BIC | M | Code | WPACAU2S |

Balances

<Bal>

<Tp>

<CdOrPrtry>

<Cd>OPBD</Cd>

</CdOrPrtry>

</Tp>

<Amt Ccy="AUD">7484527.35</Amt>

<CdtDbtInd>CRDT</CdtDbtInd>

<Dt>

<Dt>2017-12-05</Dt>

</Dt>

</Bal>- There will be 3 Balance records for each statement. They represent the opening balance (

Cd=OPBD), closing balance (Cd=CLDB) and available balance (Cd=CLAV). - The

Amtfield holds the value of the specified balance type. - The

Dtfield identifies the date that the balance refers to.

| Lev | ISO XML element | Message Item | Req | Format | Example, Description or element name |

|---|---|---|---|---|---|

| 3 | <Bal> |

Balance | M | <Bal> |

|

| 4 | <Tp> |

Type | M | <Tp> |

|

| 5 | <CdOrPrtry> |

Code Or Proprietary | M | <CdOrPrtry> |

|

| 6 | <Cd> |

Code | M | OPBD, CLDB, CLAV |

|

| 4 | <Amt Ccy="AAA"> |

Amount | M | Amount, currency specified | Balance amount |

| 4 | <CdtDbtInd> |

Credit Debit Indicator | M | Code | CRDT or DBIT |

| 4 | <Dt> |

Date | M | <Dt> |

|

| 5 | <Dt> |

Date | M | yyyy-MM-dd |

2017-12-05 |

Transaction summary

<TxsSummry>

<TtlNtries>

<NbOfNtries>687</NbOfNtries>

<Sum>13563249.33</Sum>

<TtlNetNtryAmt>10898261.33</TtlNetNtryAmt>

<CdtDbtInd>DBIT</CdtDbtInd>

</TtlNtries>

<TtlCdtNtries>

<NbOfNtries>279</NbOfNtries>

<Sum>1332494.00</Sum>

</TtlCdtNtries>

<TtlDbtNtries>

<NbOfNtries>414</NbOfNtries>

<Sum>12230755.33</Sum>

</TtlDbtNtries>

</TxsSummry>| Lev | ISO XML element | Message Item | Req | Format | Example, Description or element name |

|---|---|---|---|---|---|

| 3 | <TxsSummry> |

Transactions Summary | M | <TxsSummry> |

|

| 4 | <TtlNtries> |

Total Entries | M | <TtlNtries> |

|

| 5 | <NbOfNtries> |

Number Of Entries | M | Numeric | 5 |

| 5 | <Sum> |

Sum | M | Amount | 500.00 |

| 5 | <TtlNetNtryAmt> |

Total Net Entry Amount | M | Amount | TtlCdtNtries/Sum + TtlDbtNtries/Sum, e.g. 100.00 |

| 5 | <CdtDbtInd> |

Credit Debit Indicator | M | Code | CRDT or DBIT |

| 4 | <TtlCdtNtries> |

Total Credit Entries | M | <TtlCdtNtries> |

|

| 5 | <NbOfNtries> |

Number Of Entries | M | Numeric | 2 |

| 5 | <Sum> |

Sum | M | Amount | TtlCdtNtries/Sum - TtlDbtNtries/Sum, e.g. 300.00 |

| 4 | <TtlDbtNtries> |

Total Debit Entries | M | <TtlDbtNtries> |

|

| 5 | <NbOfNtries> |

Number Of Entries | M | Numeric | 3 |

| 5 | <Sum> |

Sum | M | Amount | 200.00 |

Transaction level

Transaction header

<Ntry>

<NtryRef>477595609</NtryRef>

<Amt Ccy="AUD">667.35</Amt>

<CdtDbtInd>DBIT</CdtDbtInd>

<Sts>BOOK</Sts>

<BookgDt>

<Dt>2018-01-03</Dt>

</BookgDt>

<ValDt>

<Dt>2018-01-03</Dt>

</ValDt>

<BkTxCd>

<Domn>

<Cd>PMNT</Cd>

<Fmly>

<Cd>ICHQ</Cd>

<SubFmlyCd>BCHQ</SubFmlyCd>

</Fmly>

</Domn>

<Prtry>

<Cd>013</Cd>

<Issr>Westpac Australia</Issr>

</Prtry>

</BkTxCd>

<NtryDtls>

...

</NtryDtls>

</Ntry>- The

NtryReffield is a unique number that identifies the bulk settlement for a transaction. - The

Amtrepresents the bulk settlement amount. - The

CdtDbtIndidentifies whether the transaction is a credit or a debit. - The two dates represent the date that the transaction was completed and the date that the funds are available.

- The

BkTxCdblock contains the Domain, Family and Sub Family codes that identify the transaction. It also contains the traditional bank transaction code for the transaction.

| Lev | ISO XML element | Message Item | Req | Format | Example, Description or element name |

|---|---|---|---|---|---|

| 3 | <Ntry> |

Entry | M | <Ntry> |

|

| 4 | <NtryRef> |

Entry Reference | M | Alphanumeric | |

| 4 | <Amt Ccy="AAA"> |

Amount | M | Amount, currency specified | Transaction amount, always positive - use credit debit indicator to differentiate. |

| 4 | <CdtDbtInd> |

Credit Debit Indicator | M | Code | CRDT or DBIT |

| 4 | <Sts> |

Status | M | Code | BOOK |

| 4 | <BookgDt> |

Booking Date | M | <BookgDt> |

|

| 5 | <Dt> |

Date | M | yyyy-MM-dd |

2018-01-03 |

| 4 | <ValDt> |

Value Date | M | <ValDt> |

|

| 5 | <Dt> |

Date | M | yyyy-MM-dd |

2018-01-03 |

| 4 | <BkTxCd> |

Bank Transaction Code | M | <BkTxCd> |

|

| 5 | <Domn> |

Domain | M | <Domn> |

|

| 6 | <Cd> |

Code | M | Code | PMNT |

| 6 | <Fmly> |

Family | M | <Fmly> |

|

| 7 | <Cd> |

Code | M | Code | ICHQ |

| 7 | <SubFmlyCd> |

Sub Family Code | M | Code | BCHQ |

| 5 | <Prtry> |

Proprietary | M | <Prtry> |

|

| 6 | <Cd> |

Code | M | Code | 013 |

| 6 | <Issr> |

Issuer | M | Alphanumeric |

Transaction details

<NtryDtls>

<TxDtls>

<Refs>

<InstrId>BI00007747</InstrId>

<EndToEndId>292</EndToEndId>

<TxId>2086196006</TxId>

</Refs>

<AmtDtls>

<TxAmt>

<Amt Ccy="AUD">667.35</Amt>

</TxAmt>

</AmtDtls>

<BkTxCd>

<Domn>

<Cd>PMNT</Cd>

<Fmly>

<Cd>ICHQ</Cd>

<SubFmlyCd>BCHQ</SubFmlyCd>

</Fmly>

</Domn>

<Prtry>

<Cd>013</Cd>

<Issr>Westpac Australia</Issr>

</Prtry>

</BkTxCd>

<AddtlTxInf>WESTPAC PPS - (CHEQUE PORTION)</AddtlTxInf>

</TxDtls>

</NtryDtls>- The

InstrIdandEndToEndIdfields contain reference data that was passed to the bank by the customer when initiating the transaction. Note that theEndToEndIdis typically passed through the banking system from the initiating payment file. TheInstrIdorPmtInfIdis held at Westpac for statement enhancement. - The

Amtcontains the amount of the particular transaction. - The

BkTxCdblock contains the Domain, Family and Sub Family codes that identify the sub-transaction. It also contains the traditional bank transaction code for the transaction. - The

AddtlTxInffield usually contains the transaction narrative that would appear on the customers' bank statement.

| Lev | ISO XML element | Message Item | Req | Format | Example, Description or element name |

|---|---|---|---|---|---|

| 4 | <NtryDtls> |

Entry Details | M | <NtryDtls> |

|

| 5 | <TxDtls> |

Transaction Details | M | <TxDtls> |

|

| 6 | <Refs> |

References | M | <Refs> |

|

| 7 | <InstrId> |

Instruction Identification | O | BI00007747 |

|

| 7 | <EndToEndId> |

End To End Identification | O | 292 |

|

| 7 | <TxId> |

Transaction Identification | O | 2086196006 |

|

| 7 | <PmtInfId> |

Payment Information Identification | O | 12345 |

|

| 6 | <AmtDtls> |

Amount Details | M | ||

| 7 | <TxAmt> |

Transaction Amount | M | ||

| 8 | <Amt Ccy="AAA"> |

Amount | M | Amount, currency specified | Transaction amount |

| 6 | <BkTxCd> |

Bank Transaction Code | M | ||

| 7 | <Domn> |

Domain | M | ||

| 8 | <Cd> |

Code | M | Code | PMNT |

| 8 | <Fmly> |

Family | M | <Fmly> |

|

| 9 | <Cd> |

Code | M | Code | ICHQ |

| 9 | <SubFmlyCd> |

Sub Family Code | M | Code | BCHQ |

| 7 | <Prtry> |

Proprietary | M | <Prtry> |

|

| 8 | <Cd> |

Code | M | Code | 013 |

| 8 | <Issr> |

Issuer | M | Alphanumeric | Westpac Australia |

| 6 | <AddtlTxInf> |

Additional Transaction Information | O | Alphanumeric | WESTPAC PPS - (CHEQUE PORTION) |

Identifying transactions

The below table lists common types of transactions that may appear in the camt.053.001.02 bank statement file. This table uses the transaction code and domain properties to identify the transaction type.

| Payment type | Transaction code | Domain code | Family code | Sub-family code | Credit/debit indicator |

|---|---|---|---|---|---|

| Cheque dishonour | 007 |

PMNT |

RCHQ |

UPCQ |

DBIT |

| PPS Refund | 013 |

PMNT |

ICHQ |

BCHQ |

DBIT |

| EFT Refund via CoL | 014 |

PMNT |

ICDT |

DMCT |

DBIT |

| Fee | 015 |

CAMT |

ACCB |

CHRG |

DBIT |

| BPAY | 022 |

PMNT |

MDOP |

ADJT |

DBIT |

| Chargeback | 022 |

PMNT |

MDOP |

ADJT |

DBIT |

| Merchant Settlement | 041 |

PMNT |

MCRD |

RIMB |

DBIT |

| PPS Refund | 046 |

PMNT |

ICDT |

ASET |

CRDT |

| EFT | 050 |

PMNT |

RCDT |

ACDT |

CRDT |

| BPAY | 050 |

PMNT |

LBOX |

LBDP |

CRDT |

| Lockbox | 050 |

PMNT |

LBOX |

LBDP |

CRDT |

| Stop Cheque | 050 |

PMNT |

ICHQ |

CQRV |

CRDT |

| Cheque Deposit | 060 |

PMNT |

CNTR |

BCDP |

CRDT |

| Cheque Deposit | 061 |

PMNT |

CNTR |

BCDP |

CRDT |

| EFT | 070 |

PMNT |

RCDT |

ACDT |

CRDT |

| EFT | 073 |

PMNT |

RCDT |

SDVA |

CRDT |

| Merchant Settlement | 095 |

PMNT |

MCRD |

RIMB |

CRDT |

| EFT Refund Returns | 269 |

PMNT |

ICDT |

ARET |

CRDT |

| Off-system BSB | 510 |

PMNT |

OTHR |

OTHR |

CRDT |

Enrichment support

If you receive a data-enriched (debulked or enriched) statement, there will be some modifications to the TxDtls element in the camt.053.001.02 file.

Debulked receivables enrichment

For debulked receivables enrichment, the following modifications will be performed to the TxDtls element of the camt.053.001.02 file:

- Each

TxDtlselement that previously represented a bulk settlement will be replaced with multipleTxDtlselements that represent multiple individual payments that formed part of the bulk settlement. TxDtls/Refs/MsgId: This element will be populated with theMessage Idfrom the Payment Batch if available, otherwise omitted.TxDtls/Refs/PmtInfId: This element be populated with thePayment Information Idfrom the Payment Batch if available, otherwise omitted.TxDtls/Refs/TxId: This element will be populated with a unique, BankRec-generated transaction identifier.TxDtls/RltdPties/Dbtr/Nm: This element will be populated with theDebtor Namefrom the transaction.TxDtls/Refs/AcctSvcrRef: This element will be omitted.TxDtls/BkTxCd/Domn/Fmly/SubFmlyCd: The value of this element will change to reflect the type of transaction (payment or refund).

| Type | Transaction code | Domain | Family code | Sub-family code |

|---|---|---|---|---|

| Merchant Transaction | 095 |

PMNT |

MCRD |

RIMB |

| Merchant Refund | 095 |

PMNT |

MCRD |

DAJT |

Debulked payables enrichment

For debulked payables enrichment, the following modifications will be performed to the TxDtls element of the camt.053.001.02 file:

- Each

TxDtlselement that previously represented a bulk settlement will be replaced with multipleTxDtlselements that represent multiple individual payments that formed part of the bulk settlement. TxDtls/Refs/InstrId: This element will be populated with theInstrument Idfrom the Payables Payment Batch if available, otherwise omitted.TxDtls/Refs/EndToEndId: This element will be populated with theEnd To End Idfrom the Payables Payment Batch if available, otherwise omitted.TxDtls/Refs/TxId: This element will be populated with a unique, BankRec-generated transaction identifier.TxDtls/RltdPties/Dbtr/Nm: This element will be populated with theDebtor Namefrom the transaction.TxDtls/Refs/AcctSvcrRef: This element will be omitted.

External entry enrichment

For external entry enrichment (i.e, transactions enriched with information from an external EFT feed), the following modifications will be performed to the TxDtls element of the camt.053.001.02 file:

TxDtls/Refs/AcctSvcrRef: This element will be omitted.TxDtls/Refs/EndToEndId: This element will be populated with thePayment Referencesourced from the external feed.TxDtls/Refs/MsgId: This element will be populated with a unique, BankRec-generated transaction identifier.TxDtls/Refs/TxId: This element will be populated with a unique, BankRec-generated external transaction identifier.TxDtls/RltdPties/Cdtr/Nm: This element will be populated if the transaction is a debit on your statement.TxDtls/RltdPties/Dbtr/Nm: This element will be populated if the transaction is a credit on your statement.

For RTGS/OTT transactions, the following modifications will also be performed to the TxDtls element:

TxDtls/RmtInf: This element will be populated with aUstrdelement, populated with thePayment Detailfrom the RTGS/OTT transaction.

New Payments Platform (NPP) payments enrichment

For any payments made on the NPP, the following modifications will be performed to the TxDtls element of the camt.053.001.02 file:

TxDtls/Refs/EndToEndId: This element will be populated with theEnd To End Idfrom the NPP transaction if available, otherwise omitted.TxDtls/Refs/PmtInfId: This element will be populated with the first 35 characters of theRemitter Descriptionfrom the NPP transaction.TxDtls/Refs/InstrId: This element will be populated with the first 35 characters of theRemitter Descriptionfrom the NPP transaction.TxDtls/Refs/TxId: This element will be populated with theTransaction Idfrom the NPP transaction if available, otherwise will be populated with thePayment Idfrom the NPP transaction.TxDtls/RltdPties/Cdtr/Nm: This element will be populated with theBeneficiary Namefrom the NPP transaction.TxDtls/RltdPties/Dbtr/Nm: This element will be populated with theRemitter Namefrom the NPP transaction.TxDtls/RltdPties/CtctDtls/Othr: This element will be populated with thePayId Typefrom the NPP transaction if available, otherwise omitted.TxDtls/RltdPties/CtctDtls/EmailAdr: This element will be populated with thePayIdfrom the NPP transaction if available, otherwise omitted.TxDtls/RltdDts/TxDtTm: This element will be populated with theReversal Datefrom the NPP transaction if the transaction is a reversal, otherwise will be populated with theDebited Datefrom the NPP transaction.TxDtls/RmtInf: This element will be populated with up to twoUstrdelements, populated with theBeneficiary Descriptionfrom the NPP transaction. These two elements should be concatenated to produce the complete description.TxDtls/RtrInf/Rsn/Cd: This element will be populated with theReversal Reason Code, or theReturn Reason Codefrom the NPP transaction if available, otherwise omitted.TxDtls/RtrInf/AddtInf: This element will be populated with theOriginal Transaction Idfrom the NPP transaction if the transaction is a return or reversal, otherwise omitted.

If you require further enrichment, you should discuss this during your implementation.

Sample files

The following files are intended to be examples only.

NPP sample transactions

Download the NPP sample camt.053.001.02 file.

This file contains examples of all NPP transaction codes, and how they will appear in a standard camt.053.001.02 statement.