BRS statement format

Balance Reporting System (BRS) is a Westpac proprietary format commonly used by Financial Management systems for account reconciliation.

The transaction description is limited to 42 characters.

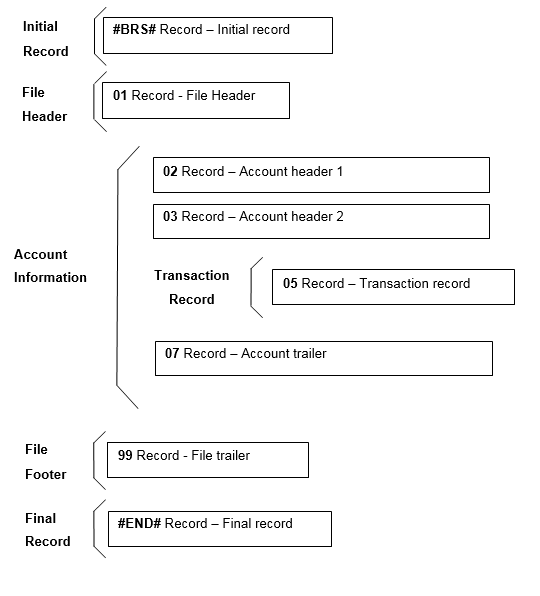

Format overview

An example of the "BankRec BRS" file format layout structure is indicated in the diagram below.

Fixed length records

The BankRec BRS file format uses fixed length records of 104 bytes per line. Each record has a fixed structure, and will be padded with whitespace to reach the 104 byte length if required.

Record termination

Each record is terminated by a CR/LF end-of-line pair.

Leading zeros

All leading zeros within file extracts will be provided, including the following leading zeros;

- Record Codes (e.g.

01,02,03etc). - Transaction Codes (e.g.

001,099etc). - Account Numbers (e.g.

032000,000007,032000000016).

Default file name format

The default file name will be generated as BankStatement_CONFIGCODE_DATE.txt where CONFIGCODE is the configuration code and DATE is the statement date.

Data formats

| Data Format | Characteristics | Example |

|---|---|---|

| Amount | Amount fields are displayed as cents, right justified and zero filled. | 50.00 = 000000000005000 |

| Sign | Follows an Amount field - + for credit amounts, - for debit amounts. |

+ |

| Date | Date fields are formatted in Julian date format of YYYYDDD where;

|

2015188 = 07 July 2015 |

File specification

Record BRS - Initial record

| Position (Length) | Field Name | Description | Data Format |

|---|---|---|---|

| 1 - 5 (5) | Record Type | Fixed value of #BRS#. |

Characters |

| 6 - 10 (5) | Sequence Number | Sequence number, incrementing by 1 for every generated statement. | Number |

| 11 - 17 (7) | Processing Date | Date of processing. | Date |

| 18 - 20 (3) | Record Trailer | Fixed value of SOD. |

Characters |

Record 01 - File header

| Position (Length) | Field Name | Description | Data Format |

|---|---|---|---|

| 1 - 2 (2) | Record Type | Fixed value of 01. |

Integer |

| 3 - 7 (5) | Bank ID | Fixed value of AU03 or AU73, depending on the BSB of the account. |

Characters |

| 8 - 14 (7) | Processing Date | Date of processing. | Date |

| 15 - 21 (7) | Previous Processing Date | Previous banking date. | Date |

| 22 - 28 (7) | Next Processing Date | Next banking date. | Date |

| 29 - 35 (7) | Next Next Processing Date | Next next banking date. | Date |

Record 02 - Account header 1

| Position (Length) | Field Name | Description | Data Format |

|---|---|---|---|

| 1 - 2 (2) | Record Type | Fixed value of 02. |

Integer |

| 3 - 7 (5) | Bank ID | Fixed value of AU03 or AU73, depending on the BSB of the account. |

Characters |

| 8 - 24 (17) | Account Number | Last 4 digits of BSB Number, and Account Number, left justifed. | Integer |

| 25 - 27 (3) | Currency Code | The ISO currency code representing the accounts currency. | Characters |

| 28 - 42 (15) | Closing Balance | Closing balance of the account. | Amount |

| 43 - 43 (1) | Closing Balance Sign | Sign for closing balance. | Sign |

| 44 - 56 (13) | Overdraft Limit | Overdraft amount. | Amount |

| 57 - 71 (15) | Accrued Interest | Amount of interest accrued. | Amount |

| 72 - 72 (1) | Accrued Interest Sign | Sign for accrued interest. | Sign |

| 73 - 87 (15) | Bank Use Only | Fixed value of 000000000000000. |

Integer |

| 88 - 88 (1) | Bank Use Only | Fixed value of +. |

Sign |

| 89 - 103 (15) | Accrued Debits Tax | Fixed value of 000000000000000. |

Integer |

| 104 - 104 (1) | Accrued Debits Tax Sign | Fixed value of -. |

Sign |

Record 03 - Account header 2

| Position (Length) | Field Name | Description | Data Format |

|---|---|---|---|

| 1 - 2 (2) | Record Type | Fixed value of 03. |

Integer |

| 3 - 17 (15) | Accrued Unused Limit Fee | Amount of accrued unused limit fee. | Amount |

| 18 - 18 (1) | Accrued Unused Limit Fee Sign | Fixed value of -. |

Sign |

| 19 - 33 (15) | Accrued Account Fee | Amount of accrued account fee. | Amount |

| 34 - 34 (1) | Accrued Account Fee Sign | Sign for accrued account fee. | Sign |

| 35 - 49 (15) | Debit Cutoff Amount | Only applicable to customers who have requested a debit cutoff limit on their transactions. | Amount |

| 50 - 64 (15) | Credit Cutoff Amount | Only applicable to customers who have requested a credit cutoff limit on their transactions. | Amount |

| 65 - 80 (16) | Account Name | Name of the account, left justified. Blank if not present. | Characters |

| 81 - 91 (11) | Bank Use Only | Fixed value of "0 00 0". | Characters |

Record 05 - Transaction record

| Position (Length) | Field Name | Description | Data Format |

|---|---|---|---|

| 1 - 2 (2) | Record Type | Fixed value of 05. |

Integer |

| 3 - 17 (15) | Transaction Amount | The amount for the transaction. | Amount |

| 18 - 18 (1) | Transaction Amount Sign | Sign for transaction amount. | Sign |

| 19 - 21 (3) | Transaction Code | Three digit code identifying the type of transaction. | Integer |

| 22 - 63 (42) | Narrative | Human-readable information about the transaction, left justifed. | Characters |

| 64 - 70 (7) | Serial Number | Serial number. If not present, will be populated with " 0". | Characters |

| 71 - 71 (1) | Bank Use Only | Blank. | Character |

| 72 - 83 (12) | Segment BSB and Account Number | Segment account identifier. Blank for non-segmented accounts. | Integer |

Record 07 - Account trailer

| Position (Length) | Field Name | Description | Data Format |

|---|---|---|---|

| 1 - 2 (2) | Record Type | Fixed value of 07. |

Integer |

| 3 - 17 (15) | Total Debit Amount | Sum of all debit transaction amounts. | Amount |

| 18 - 22 (5) | Debit Transaction Count | Number of debit transactions, right justifed and zero filled. | Integer |

| 23 - 37 (15) | Total Credit Amount | Sum of all credit transaction accounts. | Amount |

| 38 - 42 (5) | Credit Transaction Count | Number of credit transactions, right justified and zero filled. | Integer |

| 43 - 58 (16) | Account Total Amount | This amount is calculated as follows:

|

Amount |

| 59 - 59 (1) | Account Total Amount Sign | Sign for the account total amount. | Sign |

| 60 - 65 (6) | Total Transaction Count | Total count of all transactions, right justified and zero filled. | Integer |

Record 99 - File trailer

| Position (Length) | Field Name | Description | Data Format |

|---|---|---|---|

| 1 - 2 (2) | Record Type | Fixed value of 99. |

Integer |

| 3 - 18 (16) | File Total Amount | Sum of all 'Account Total Amount' records. | Amount |

| 19 - 19 (1) | File Total Amount Sign | Sign for file total amount. | Sign |

| 20 - 25 (6) | Total Number Of Records | Number of 01, 02, 03, 05 and 07 records in the file, right justifed and zero filled. |

Integer |

| 26 - 31 (6) | Total Number Of Transactions | Number of 05 records in the file, right justified and zero filled. |

Integer |

Record END - Final record

| Position (Length) | Field Name | Description | Data Format |

|---|---|---|---|

| 1 - 5 (5) | Record Type | Fixed value of #END#. |

Characters |

Format variations

The following outlines the differences between the Westpac BankRec BRS format and the WIBS-AI BRS format.

| Record | Field Name | Difference |

|---|---|---|

| BRS | Sequence Number | BankRec will populate a sequence number where WIBS-AI populates with zeros. |

| 02 | Accrued Debits Tax Sign | BankRec always has a minus in this field where it will be a plus in WIBS-AI. |

| 03 | Accrued Account Fee Sign | BankRec always has a plus in this field where it will be a minus in WIBS-AI. |

| 03 | Account Name | BankRec may not always provide an Account Name field where WIBS-AI does. |

| 05 | Bank Use Only | BankRec has this field Blank, where WIBS-AI has a 0 in this field. |

The following outlines the differences between the Westpac BankRec BRS format and the Deskbank/Corporate Online BRS format.

| Record | Field Name | Difference |

|---|---|---|

| n/a | n/a | BankRec will zero fill amount fields where Corporate Online may leave them blank. |

| BRS | Sequence Number | BankRec will populate a sequence number where Corporate Online populates with zeros. |

| 02 | Accrued Debits Tax Sign | BankRec always has a minus in this field where it will be a plus in Corporate Online. |

Sample files

The following files are intended to be examples only.

NPP sample transactions

Download the NPP sample BRS file.

This file contains examples of all NPP transaction codes, and how they will appear in a standard BRS statement.