BAI2 statement format

BAI2, also called the "Bank Administration Institute Version 2", is the upgraded version of the BAI file format.

It was introduced by the "Bank Administration Institute", based in the US, to facilitate previous day reporting of account balance information to clients and their agents, for activities that have occurred on a client's accounts.

The main objective of the BAI2 file format is to provide clients with structured, machine-readable account information that can be consumed and processed by client systems automatically, to provide sufficient account information to support their business needs including automated account reconciliation processes (i.e. ERP "Electronic Reconciliation Processing" systems like SAP, MYOB etc).

Format overview

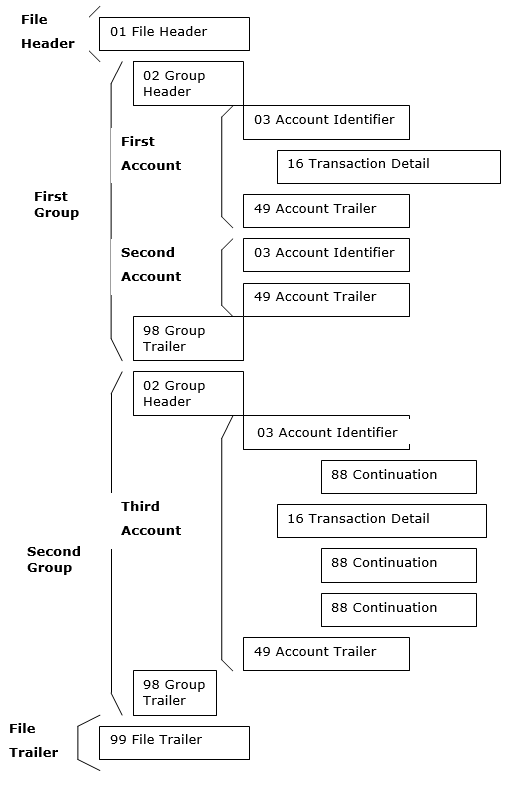

The following diagram depicts the BAI2 file layout.

The following table defines the record types shown above.

| Record Code | Record Name | Purpose | Location in File | Mandatory/Optional |

|---|---|---|---|---|

01 |

File Header | Marks the beginning of a file. Identifies the;

|

Begins File | Mandatory |

02 |

Group Header | Marks the beginning of a group. Identifies the group of accounts sent in the file that are from the same sender. Provides the;

|

Begins Group | Mandatory |

03 |

Account Identifier | Marks the beginning of an account record. Identifies the following account information for the given account;

|

Begins Account | Mandatory |

16 |

Account Transaction Detail | Provides transaction detail information. Identifies the;

|

Follows Record 03 | Optional |

88 |

Continuation | For continuation of 03 or 16 records. | Follows Record 03, 16 or 88 | Optional |

49 |

Account Trailer | Marks the end of an account. Provides the;

|

Ends Account | Mandatory |

98 |

Group Trailer | Marks the end of a group within a file. Identifies the;

|

Ends Group | Mandatory |

99 |

File Trailer | Marks the end of a File. Identifies the;

|

Ends File | Mandatory |

Note:

- A file will contain only a single group. The group will start with record 02 (Group Header) and end with record 98.

- A group may contain several accounts. Each account record will start with record 03 and end with record 49.

- An account may or may not contain records 16 or 88, as these are optional records within a file.

Fixed length records

The BankRec BAI2 file format uses fixed length records, up to 80 bytes per line, including any "comma" delimiter characters and the "slash" record termination character.

Field delimiters

Each record within a file contains fields, which are delimited according to the following rules;

- Each field within a record is delimited with a "comma" (

,). - Optional fields that have been defaulted or left unspecified are indicated by adjacent delimiters. If there are additional fields following the defaulted field, they are indicated by two "commas" (

,,). If the defaulted field is the last field in the record, it is indicated by a "comma" followed by a "slash" (,/). - A "comma" (

,) and "slash" (/) cannot be used as data fields within a file, except in text fields, as they are used as field and record delimiters respectively. They can appear within "text" fields, but may not be used to begin the text field.

Record termination

There are two rules for terminating a record within a given file. They are;

- The end of a record that does not include text, should always be terminated by the "slash" delimiter (

/). Example: Header Record 01 indicated below.

01,021000021,G5702364 COL,060202,1301,001,,,2/

- The end of a continuation record that includes text should not be indicated by any delimiter. These records are delimited by the next non-continuation record. Example: Account records 16 and 88 indicated below.

16,175,631500,Z,0003930045232,0013256202/

88,YOUR REF=0013256202

Leading zeros

All leading zeros within file extracts will be provided, including the following leading zeros;

- Record codes (e.g.

01,02,03etc). - Type Codes (e.g.

001,099etc). - Account Numbers (e.g.

032000,000007,032000000016).

Default file name format

The default file name will be generated as BankStatement_CONFIGCODE_DATE.txt where CONFIGCODE is the configuration code and DATE is the statement date.

File specification

Record 01 - File header

| Field Number | Field Name | Field Description | Data Format (Length) | Mandatory/Optional |

|---|---|---|---|---|

| 1 | Record Code | Fixed value of 01. |

Integer (2) | Mandatory |

| 2 | Sender ID | Fixed value of WPACAU2DK. |

Characters (9) | Mandatory |

| 3 | Receiver ID | The iLink "System Code" (i.e. system code that is receiving the message). | Characters | Mandatory |

| 4 | File Creation Date | The file creation date in AEST date, and format of YYMMDD. |

Date/Integer (6) | Mandatory |

| 5 | File Creation Time | The file creation time in AEST time, and format of hhmm. |

Time/Integer (4) | Mandatory |

| 6 | File ID Number | Fixed value of 01. |

Integer (2) | Mandatory |

| 7 | Physical Record Length | The maximum character length of a record. | Integer (3) | Optional |

| 8 | Block Size | Blank. | Blank | Optional |

| 9 | BAI Version | Fixed value of 2. |

Integer (1) | Mandatory |

Sample - Record 01:

01,WPACAU2DK,WIBSCUST,060302,1301,01,080,,2/

Meaning: The sender Bank Westpac (WPACAU2DK) is sending data to receiver (WIBSCUST) on 2nd Mar 2006 13:01 hrs. This is the first file of the day, with physical record length of 080 and in BAI file version number 2.

Record 02 - Group header

| Field Number | Field Name | Field Description | Data Format (Length) | Mandatory/Optional |

|---|---|---|---|---|

| 1 | Record Code | Fixed value of 02. |

Integer (2) | Mandatory |

| 2 | Ultimate Receiver ID | The iLink "System Code" (i.e. system code that is receiving the message). Will match the Receiver ID in Record 01. | Characters | Optional |

| 3 | Originator ID | Fixed value of WPACAU2DK. |

Characters | Mandatory |

| 4 | Group Status | Fixed value of 1, indicating "Update" status. |

Integer (1) | Mandatory |

| 5 | As of Date | The originator date for which account information provided within a given group in the file is being reported in AEST date, and format of YYMMDD. |

Date/Integer (6) | Mandatory |

| 6 | As of Time | Blank. | Blank | Optional |

| 7 | Currency Code | The base ISO Currency Code for the Country of the file sender. | Characters (3) | Optional |

| 8 | As of Date Modifier | Fixed value of 2, as Westpac account information is available as of previous day. |

Integer (1) | Optional |

Sample 02 Record:

02,WIBSCUST,WPACAU2DK,1,060302,,AUD,2/

Meaning: The receiver (WIBSCUST) is receiving update data (1) from sender Bank Westpac (WPACAU2DK) on 2nd Mar 2006 in Australian dollars for the previous day.

Record 03 - Account identifier and summary status

| Field Number | Field Name | Field Description | Data Format (Length) | Mandatory/Optional |

|---|---|---|---|---|

| 1 | Record Code | Fixed value of 03. |

Integer (2) | Mandatory |

| 2 | Customer Account Number | Populated with the customer account (BSB and account number). | Integer | Mandatory |

| 3 | Currency Code | The ISO currency code representing the accounts currency. | Characters (3) | Optional |

| 4 | Type Code | The account summary or account status activity reported within this record. Information related to these type codes can be found in the section Type Codes of this document specification. | Integer (3) | Optional |

| 5 | Amount | The value of the activity identified by the preceding Type Code. Provided without decimal places. Signed for Type Codes 010, 015 and 045, unsigned for Type Codes 100 and 400. | Float | Optional |

| 6 | Item Count | For Type Codes 010, 015 and 045, this field will be left Blank. For Type Code 100 and 400, total count of transactions. | Integer | Optional |

| 7 | Funds Type | Blank. | Blank | Optional |

| Field Numbers 4, 5, 6 and 7 are repeated until all account status and summary information for a given account has been reported. |

Sample 03 Record:

03,032000000007,AUD,010,300000,,,015,-100000,,,045,765000,,,/

88,100,9760000,1,,400,503333,2,/

Meaning: The following account information for Customer account 032000000007 has been reported within this record.

- Opening Balance of 3000.00 AUD.

- Closing Balance of -10000.00 AUD.

- Available Closing Balance of 7650.00 AUD.

- Total value of Credit transactions is 97600.00 AUD, with 1 transaction.

- Total value of Debit transactions is 5033.33 AUD, with 2 transactions.

Record 16 - Transaction detail

| Field Number | Field Name | Field Description | Data Format (Length) | Mandatory/Optional |

|---|---|---|---|---|

| 1 | Record Code | Fixed value of 16. |

Integer (2) | Mandatory |

| 2 | Type Code | See BAI2 codes described in Type Codes. | Integer (3) | Mandatory |

| 3 | Amount | The unsigned value of the transaction. Provided without decimal places. | Float | Optional |

| 4 | Funds Type | Fixed value of Z, indicating an "Unknown" funds type. |

Character (1) | Optional |

| 5 | Bank Reference | The "Westpac Reference" allocated to a transaction. | Character | Optional |

| 6 | Customer Reference | The "Customer Reference" received from clients. Populated with reference data received from clients, which may include cheque serial numbers or other transaction identifier information. | Integer | Optional |

| 7 | Text | The "Narrative" for a transaction. Provides additional, human-readable information about a transaction. Note: When this field is present, it will always be reported in an 88 record immediately following this record. |

Character | Optional |

Record 88 - Continuation

Record 88 is used to continue a Record 03, 16 or 88, when these records exceed the maximum record character limit.

| Field Number | Field Name | Field Description | Data Format (Length) | Mandatory/Optional |

|---|---|---|---|---|

| 1 | Record Code | Fixed value of 88. |

Integer (2) | Mandatory |

| 2 | (Next Field) | Continues the information being reported in the preceding record. If this record is succeding an 03 record, this field will be continuing the account information from the preceding record.If this record is succeding a 16 record, this field will be populated with;

|

Characters | Mandatory |

Sample 03 Record Continuation:

03,032000000007,AUD,010,904444445,,,015,904444453,,,045,904444453,,,100,200000/

88,10,,400,500000,10,/

Sample 16 Record Continuation:

16,698,90000,Z,0000050000,/

88,YOUR REFERENCE: IA000000000

Record 49 - Account trailer

| Field Number | Field Name | Field Description | Data Format (Length) | Mandatory/Optional |

|---|---|---|---|---|

| 1 | Record Code | Fixed value of 49. |

Integer (2) | Mandatory |

| 2 | Account Control Total | The signed, algebraic sum of all "Amount" fields reported within the preceding account records. Provided without decimal places. | Float | Mandatory |

| 3 | Number of Records | The total number of records reported for this account (i.e. Count of all 03, 16, 88 and 49 Records reported for this account). |

Integer | Mandatory |

Sample 49 Record:

49,98530055,8/

Meaning: The total value of amounts reported for this account is 985300.55 AUD, over 8 records.

Record 98 - Group trailer

| Field Number | Field Name | Field Description | Data Format (Length) | Mandatory/Optional |

|---|---|---|---|---|

| 1 | Record Code | Fixed value of 98. |

Integer (2) | Mandatory |

| 2 | Group Control Total | The signed, algebraic sum of all "Amounts" reported within all "Account Control Total" fields from record 49, within this group. Provided without decimal places. |

Float | Mandatory |

| 3 | Number of Accounts | The total number of accounts reported in this group. (i.e. Count of 03 records in this group). |

Integer | Mandatory |

| 4 | Number of Records | The total number of records reported in this group (i.e. Count of all 02, 03, 16, 88, 49 and 98 Records reported for this group). |

Integer | Mandatory |

Sample 98 Record:

98,1093333111333,28,117/

Meaning: The total value of amount reported for this group is 10933331113.33 AUD, for 28 accounts reported in 117 records.

Record 99 - File trailer

| Field Number | Field Name | Field Description | Data Format (Length) | Mandatory/Optional |

|---|---|---|---|---|

| 1 | Record Code | Fixed value of 99. |

Integer (2) | Mandatory |

| 2 | File Control Total | The signed, algebraic sum of all "Amounts" reported within all "Group Control Total" fields from all 98 records within this file. Provided without decimal places. |

Float | Mandatory |

| 3 | Number of Groups | The total number of groups reported in this file (i.e. Count of 02 records in this file). |

Integer | Mandatory |

| 4 | Number of Records | The total number of records reported in this file (i.e. Count of all 01, 02, 03, 16, 88, 49, 98 and 99 Records reported per account). |

Integer | Mandatory |

Sample 99 Record:

99,1093333111333,10,315/

Meaning: The total value of amount reported for this file is 10933331113.33 AUD, for 10 groups reported in 315 records.

Type codes

Account status - Type codes

| Type Code | Description |

|---|---|

010 |

Opening Balance |

015 |

Closing Balance |

045 |

Available Closing Balance |

Account summary - Type codes

| Type Code | Description |

|---|---|

100 |

Total Value of all Credit transactions |

400 |

Total Value of all Debit transactions |

Transaction codes

Westpac Australia - Transaction detail codes

The "BAI2 Code" for a transaction is determined from the incoming Westpac Transaction Code, using mappings described below. The "Text" for the transaction is the associated "Westpac Narrative" specified below.

The "BAI2 Code Name" listed in the table below is provided for reference purposes only.

| Westpac Transaction Code | Westpac Narrative | Corresponding BAI2 Code | BAI2 Code Name |

|---|---|---|---|

050 |

DEPOSIT | 142 |

ACH CREDIT RECEIVED |

051 |

DEPOSIT INTEREST FROM GOV'T INVESTMENT | 142 |

ACH CREDIT RECEIVED |

052 |

DEPOSIT-FAMILY ALLOWANCE | 142 |

ACH CREDIT RECEIVED |

053 |

DEPOSIT-SALARY | 142 |

ACH CREDIT RECEIVED |

054 |

DEPOSIT-PENSION | 142 |

ACH CREDIT RECEIVED |

056 |

DEPOSIT DIVIDEND | 142 |

ACH CREDIT RECEIVED |

057 |

DEPOSIT-DEBENTURE/NOTE INTEREST | 142 |

ACH CREDIT RECEIVED |

060 |

DEPOSIT | 142 |

ACH CREDIT RECEIVED |

095 |

MERCHANT SETTLEMENT | 147 |

INDIVIDUAL BANK CARD DEPOSIT |

159 |

EXPORT PROCEEDS RECEIVED REFERENCE | 164 |

CORPORATE TRADE PAYMENT CREDIT |

271 |

PROCEEDS EXPORT BILL NEGOTIATED REFERENCE | 164 |

CORPORATE TRADE PAYMENT CREDIT |

510 |

DEPOSIT | 167 |

ACH SETTLEMENT CREDITS |

269 |

DIRECT CREDIT RETURNED | 168 |

ACH RETURN ITEM OR ADJUSTMENT SETTLEMENT |

072 |

CHEQUE RECEIVED-OMITTED FROM DEPOSIT | 172 |

DEPOSIT CORRECTION |

076 |

MERCHANT AMOUNT OMITTED FROM DEPOSIT | 172 |

DEPOSIT CORRECTION |

080 |

CHEQUE AMOUNT INCORRECT ON DEPOSIT | 172 |

DEPOSIT CORRECTION |

097 |

BUSINESS EXPRESS DEPOSIT - CASH ERROR | 172 |

DEPOSIT CORRECTION |

151 |

COS CASH ERROR | 172 |

DEPOSIT CORRECTION |

168 |

ERROR IN DEPOSIT | 172 |

DEPOSIT CORRECTION |

295 |

ERROR IN ADDITION ON DEPOSIT | 172 |

DEPOSIT CORRECTION |

856 |

ADJUSTMENT FOR ERROR IN PROCESSING ON | 172 |

DEPOSIT CORRECTION |

086 |

ERROR IN CARRY FORWARD OF CHEQUE TOTAL | 173 |

BANK-PREPARED DEPOSIT |

050 |

DEPOSIT | 174 |

OTHER DEPOSIT |

859 |

DEPOSIT - FUNDS TRANSFERRED | 174 |

OTHER DEPOSIT |

050 |

DEPOSIT | 175 |

CHECK DEPOSIT PACKAGE |

060 |

DEPOSIT | 175 |

CHECK DEPOSIT PACKAGE |

061 |

DEPOSIT | 175 |

CHECK DEPOSIT PACKAGE |

167 |

DEPOSIT | 175 |

CHECK DEPOSIT PACKAGE |

073 |

RTGS HIGH VALUE PAYMENT REF NO | 195 |

INCOMING MONEY TRANSFER |

094 |

PERIODICAL PAYMENT FROM | 195 |

INCOMING MONEY TRANSFER |

098 |

AUSTRACLEAR PAYMENT REF NO | 195 |

INCOMING MONEY TRANSFER |

155 |

PROCEEDS FROM TELEGRAPHIC TRANSFER | 195 |

INCOMING MONEY TRANSFER |

194 |

DEPOSIT - INTERNET ONLINE BANKING | 195 |

INCOMING MONEY TRANSFER |

251 |

DEPOSIT | 195 |

INCOMING MONEY TRANSFER |

859 |

DEPOSIT - FUNDS TRANSFERRED | 195 |

INCOMING MONEY TRANSFER |

886 |

DEPOSIT | 195 |

INCOMING MONEY TRANSFER |

887 |

DEPOSIT-OSKO PAYMENT | 195 |

INCOMING MONEY TRANSFER |

154 |

REVERSAL OF DEBIT TRANSACTION ON | 196 |

MONEY TRANSFER ADJUSTMENT |

196 |

PROCEEDS OVERSEAS TELEGRAPHIC TRANSFER | 208 |

INDIVIDUAL INTERNATIONAL MONEY TRANSFER CREDIT |

186 |

OVERSEAS ITEM AS ADVISED | 221 |

FOREIGN CHECK PURCHASE |

094 |

PERIODICAL PAYMENT FROM | 227 |

STANDING ORDER |

197 |

MONEY MARKET DEPOSIT TRANSACTION | 244 |

INTEREST/MATURED PRINCIPAL PAYMENT |

190 |

DISCOUNT SECURITY TRANSACTION | 246 |

COMMERCIAL PAPER |

150 |

PRINCIPAL PAID ON | 249 |

MISCELLANEOUS SECURITY CREDIT |

154 |

REVERSAL OF DEBIT TRANSACTION ON | 252 |

DEBIT REVERSAL |

895 |

DEPOSIT-PAYMENT REVERSAL | 252 |

DEBIT REVERSAL |

896 |

DEPOSIT-OSKO PAYMENT REVERSAL | 252 |

DEBIT REVERSAL |

891 |

DEPOSIT-PAYMENT RETURN | 266 |

RETURN ITEM |

892 |

DEPOSIT-OSKO PAYMENT RETURN | 266 |

RETURN ITEM |

188 |

TRANSFER/REPLENISHMENT FROM ACCOUNT | 275 |

ZBA CREDIT |

062 |

DEPOSIT WESTPAC CHESS SETTLEMENT | 342 |

BROKER DEPOSIT |

610 |

DEPOSIT TERMINATION OF CASH DEPOSIT | 350 |

INVESTMENT SOLD |

153 |

INTEREST PAID ON | 354 |

INTEREST CREDIT |

195 |

INTEREST PAID | 354 |

INTEREST CREDIT |

280 |

CREDIT INTEREST TRANSFERRED FROM ACCOUNT | 354 |

INTEREST CREDIT |

065 |

INTEREST ADJUSTMENT FOR | 359 |

INTEREST ADJUSTMENT CREDIT |

192 |

INTEREST ADJUSTMENT | 359 |

INTEREST ADJUSTMENT CREDIT |

169 |

REVERSAL OF DISHONOURED CHEQUE | 395 |

CHECK REVERSAL |

161 |

REFUND OF FEE CHARGED ON | 398 |

MISCELLANEOUS FEE REFUND |

050 |

DEPOSIT | 399 |

MISCELLANEOUS CREDIT |

060 |

DEPOSIT | 399 |

MISCELLANEOUS CREDIT |

061 |

DEPOSIT | 399 |

MISCELLANEOUS CREDIT |

013 |

PAYMENT BY AUTHORITY TO | 451 |

ACH DEBIT RECEIVED |

037 |

IMPORT COLLECTION PAID REFERENCE | 464 |

CORPORATE TRADE PAYMENT DEBIT |

106 |

DRAWING-IMPORT LETTER OF CREDIT | 464 |

CORPORATE TRADE PAYMENT DEBIT |

116 |

IMPORT ITEM AS ADVISED | 464 |

CORPORATE TRADE PAYMENT DEBIT |

046 |

DIRECT ENTRY DRAWING | 466 |

ACH SETTLEMENT |

513 |

WITHDRAWAL | 466 |

ACH SETTLEMENT |

207 |

DIRECT DEBIT REJECTED | 468 |

ACH RETURN ITEM OR ADJUSTMENT SETTLEMENT |

209 |

DIRECT DEBIT RETURNED | 468 |

ACH RETURN ITEM OR ADJUSTMENT SETTLEMENT |

000 |

WITHDRAWAL/CHEQUE | 475 |

CHECK PAID |

001 |

WITHDRAWAL | 475 |

CHECK PAID |

005 |

WITHDRAWAL BY COUNTER CHEQUE | 475 |

CHECK PAID |

009 |

WITHDRAWAL BY CHEQUE | 475 |

CHECK PAID |

006 |

RITS PAYMENT REF NO | 495 |

OUTGOING MONEY TRANSFER |

014 |

WITHDRAWAL FOR | 495 |

OUTGOING MONEY TRANSFER |

029 |

RTGS HIGH VALUE PAYMENT REF NO | 495 |

OUTGOING MONEY TRANSFER |

109 |

PROVISION FOR LOCAL TELEPHONE TRANSFER | 495 |

OUTGOING MONEY TRANSFER |

122 |

WITHDRAWAL - INTERNET ONLINE BANKING | 495 |

OUTGOING MONEY TRANSFER |

127 |

WITHDRAWAL - TELEPHONE BANK SELF-SERVICE | 495 |

OUTGOING MONEY TRANSFER |

134 |

WITHDRAWAL - INTERNET ONLINE BANKING | 495 |

OUTGOING MONEY TRANSFER |

203 |

WITHDRAWAL | 495 |

OUTGOING MONEY TRANSFER |

803 |

WITHDRAWAL | 495 |

OUTGOING MONEY TRANSFER |

817 |

WITHDRAWAL-OSKO PAYMENT | 495 |

OUTGOING MONEY TRANSFER |

137 |

OVERSEAS TELEGRAPHIC TRANSFER REFERENCE | 508 |

INDIVIDUAL INTERNATIONAL MONEY TRANSFER DEBITS |

239 |

CANCEL'N COSTS - FORWARD EXCHANGE CONTRACT | 514 |

FOREIGN EXCHANGE DEBIT |

003 |

PERIODICAL PAYMENT TO | 527 |

STANDING ORDER |

148 |

WITHDRAWAL FOR WESTPAC CHESS SETTLEMENT | 535 |

PURCHASE OF EQUITY SECURITIES |

237 |

MONEY MARKET DEPOSIT TRANSACTION | 544 |

INTEREST/MATURED PRINCIPAL PAYMENT |

235 |

DISCOUNT SECURITY TRANSACTION | 546 |

COMMERCIAL PAPER |

011 |

AUSTRACLEAR PAYMENT REF NO | 549 |

MISCELLANEOUS SECURITY DEBIT |

007 |

REVERSAL OF DEPOSIT DUE TO CHEQUE/S UNPAID | 555 |

DEPOSITED ITEM RETURNED |

870 |

WITHDRAWAL-PAYMENT RETURN | 566 |

RETURN ITEM |

874 |

WITHDRAWAL-OSKO PAYMENT RETURN | 566 |

RETURN ITEM |

114 |

TRANSFER/REPLENISHMENT BY AUTHORITY | 575 |

ZBA DEBIT |

144 |

FINANCIAL INSTITUTIONS LEVY - NORFOLK IS. | 575 |

ZBA DEBIT |

231 |

FUNDS TRANSFERED TO TERM DEPOSIT | 650 |

INVESTMENTS PURCHASED |

231 |

FUNDS TRANSFERED TO TERM DEPOSIT | 651 |

INDIVIDUAL INVESTMENT PURCHASED |

017 |

INTEREST | 654 |

INTEREST DEBIT |

104 |

INTEREST PAYABLE ON ACCOUNT | 654 |

INTEREST DEBIT |

025 |

INTEREST ADJUSTMENT FOR | 659 |

INTEREST ADJUSTMENT DEBIT |

217 |

INTEREST ADJUSTMENT | 659 |

INTEREST ADJUSTMENT DEBIT |

102 |

REVERSAL OF CREDIT TRANSACTION ON | 694 |

DEPOSIT REVERSAL |

845 |

CHARGEBACK | 694 |

DEPOSIT REVERSAL |

004 |

BUSINESS EXPRESS DEPOSIT - CASH ERROR | 695 |

DEPOSIT CORRECTION DEBIT |

016 |

ERROR IN DEPOSIT | 695 |

DEPOSIT CORRECTION DEBIT |

200 |

DEPOSIT INCLUDES FOREIGN CURRENCY CHEQUE | 695 |

DEPOSIT CORRECTION DEBIT |

204 |

MERCHANT SUMMARY MISSING FROM ENVELOPE | 695 |

DEPOSIT CORRECTION DEBIT |

219 |

ERROR IN ADDITION ON DEPOSIT | 695 |

DEPOSIT CORRECTION DEBIT |

247 |

THIRD PARTY CHEQUE TO BE VERIFIED | 695 |

DEPOSIT CORRECTION DEBIT |

287 |

MERCHANT ENVELOPE NOT RECEIVED WITH DEP. | 695 |

DEPOSIT CORRECTION DEBIT |

289 |

CHEQUE AMOUNT INCORRECT ON DEPOSIT | 695 |

DEPOSIT CORRECTION DEBIT |

298 |

ERROR IN CARRY FORWARD OF CHEQUE TOTAL | 695 |

DEPOSIT CORRECTION DEBIT |

826 |

ADJUSTMENT FOR ERROR IN PROCESSING ON | 695 |

DEPOSIT CORRECTION DEBIT |

001 |

WITHDRAWAL | 698 |

MISCELLANEOUS FEES |

015 |

FEE | 698 |

MISCELLANEOUS FEES |

018 |

COMMISSION | 698 |

MISCELLANEOUS FEES |

031 |

COMMISSION - EXPORT BILL REFERENCE | 698 |

MISCELLANEOUS FEES |

038 |

COMMISSION IMPORT COLLECTION REFERENCE | 698 |

MISCELLANEOUS FEES |

039 |

FEE FOR DEPOSIT BOOK | 698 |

MISCELLANEOUS FEES |

042 |

MERCHANT CHARGES | 698 |

MISCELLANEOUS FEES |

100 |

ESTABLISHMENT FEE-IMPORT LETTER OF CREDIT | 698 |

MISCELLANEOUS FEES |

112 |

AMENDMENT FEE-IMPORT LETTER OF CREDIT | 698 |

MISCELLANEOUS FEES |

126 |

DOCUMENT HANDLING FEE | 698 |

MISCELLANEOUS FEES |

128 |

BANK GUARANTEE FEE | 698 |

MISCELLANEOUS FEES |

145 |

TRANSFER OF FEE FROM | 698 |

MISCELLANEOUS FEES |

243 |

WITHDRAWAL FOR SETTLEMENT | 698 |

MISCELLANEOUS FEES |

013 |

PAYMENT BY AUTHORITY TO | 699 |

MISCELLANEOUS DEBIT |

014 |

WITHDRAWAL FOR | 699 |

MISCELLANEOUS DEBIT |

017 |

INTEREST | 699 |

MISCELLANEOUS DEBIT |

Occasionally Westpac will introduce new transaction codes. If a transaction code is received that is not explicity defined above, it will appear as a 399 (Miscellaneous Credit) or 699 (Miscellaneous Debit). A more appropriate code will be assigned at a later date.

Format variations

The following outlines the differences between the Westpac BankRec BAI2 format and the legacy Westpac WIBS-AI BAI2 format.

| Row Type | Field | Difference |

|---|---|---|

| 01 | Field 3 | WIBS-AI and BankRec will have different receiving IDs values. |

| 01 | Field 7 | BankRec pads this field to 3 digits where WIBS does not. |

| 02 | Field 2 | WIBS-AI and BankRec will have different receiving IDs values. |

| 03 | Field 6 | BankRec does not pad this field as per the above specification where WIBS does. |

| 03 | Fields 4 - 7 | The order of the account summary activities will change between WIBS-AI and BankRec. |

| 02/98 | n/a | BankRec will provide a single account group in a physical file where WIBS-AI provides a group for each individual account. |

| 88 | n/a | BankRec narratives may include additional padding when compared to WIBS-AI. |

| 49 | Field 2 | BankRec sums all amount fields when calculating the Account Control Total where WIBS-AI omit the total Credit/Debit values from Record 03 |

Enrichment support

If you receive a data-enriched (bulked, reconciled or debulked) statement there will be some modifications to the Transaction Detail records.

Bulked/reconciled enrichment

For bulked and reconciled enrichment, the following modifications will be applied to the 16 record:

Bank Reference: This field will be populated with a unique, BankRec-generated transaction identifier.Customer Reference: This field will be populated with theBatch Payment Reference Code.

Debulked recievables enrichment

For debulked recievables enrichment, the following modifications will be applied to the 16 record:

- Each 16 record that previously represented a bulk settlement record will be replaced with multiple 16 records representing each transaction that formed the bulk settlement.

Bank Reference: This field will be populated with theCustomer Reference Number.Customer Reference: This field will be populated with thePayment Reference Code.

Debulked payables enrichment

For debulked payables enrichment, the following modifications will be applied to the 16 record:

- Each 16 record that previously represented a bulk settlement record will be replaced with multiple 16 records representing each transaction that formed the bulk settlement.

Bank Reference: This field will be populated with thePayer Reference.Customer Reference: This field will be populated with thePayee Reference.

External entry enrichment

For external entry enrichment (i.e, transactions enriched with information from an external EFT feed), the following modifications will be applied to the 16 record:

Bank Reference: This field will be populated with theCustomer Codesourced from the external feed.Customer Reference: This field will be populated with theRemitter Namesourced from the external feed.

If you require further enrichment (transaction code manipulation, alternate reference values, etc.), you should discuss this during your implementation.

Sample files

The following files are intended to be examples only.

NPP sample transactions

Download the NPP sample BAI2 file.

This file contains examples of all NPP transaction codes, and how they will appear in a standard BAI2 statement.